31+ Take Home Pay Calculator Maryland

Web Maryland State Tax Calculation for 9000000 Salary The table below details how Maryland State Income Tax is calculated in 2023. Web Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Marlow Columbia Md Apartments For Rent

Web Use our Maryland Paycheck calculator to calculate your take home pay your gross pay your state and federal taxes including other government dues.

. Web Use this calculator if you are a nonresident of Maryland and have income subject to Maryland tax in 2021. Web Calculate your Maryland net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free. Web For 2023 Marylands Unemployment Insurance Rates range from 1 to 105 and the wage base is 8500 per year.

This net pay calculator can be used for estimating taxes and net pay. Web Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Maryland. Web This version of Net Pay Calculator should be used by those who submitted Federal W-4 in 2020 or later.

Well do the math for youall you. Web Maryland Income Tax Calculator 2022-2023 If you make 70000 a year living in Maryland you will be taxed 11177. That means that your net pay will be 43426 per year or 3619 per.

Withholding Calculators Employer Withholding Calculator - Tax. Open an Account Earn 14x the National Average. Payroll Schedules Salary Scales Forms Contact.

Simply enter their federal and state W. The Income Tax calculation for. The livable wage in Maryland for a single.

Web This 7500000 Salary Example for Maryland is based on a single filer with an annual salary of 7500000 filing their 2023 tax return in Maryland in 2023. Web Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Maryland. If you make 55000 a year living in the region of Maryland USA you will be taxed 11574.

These rates of course vary by year. Your average tax rate is 1167 and your marginal tax rate is. Web Home Maryland Taxes Marylands Money Comptroller of Maryland Media Services Online Services Search.

Easy 247 Online Access. You can alter the.

University Of Maryland Baltimore County The Princeton Review College Rankings Reviews

Paycheck Calculator Take Home Pay Calculator

.jpg)

Owings Park Apartments 9202 Owings Park Drive Owings Mills Md Rentcafe

Pdf Trends In Handwashing Behaviours For Covid 19 Prevention Longitudinal Evidence From Online Surveys In 10 Sub Saharan African Countries

The Geography Of Emergency Department Based Hiv Testing In South Africa Can Patients Link To Care Eclinicalmedicine

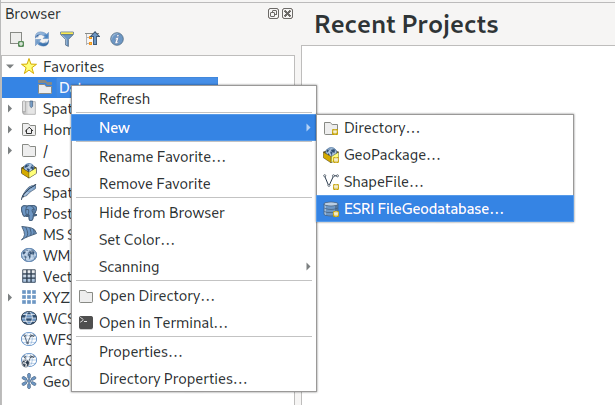

Qgis Plugins Planet

Susan Mcfarland Gaithersburg Md Real Estate Agent Realtor Com

Ten Year Plan Maryland Public Service Commission

Sacrifices Saving 50 Of Take Home Pay Bogleheads Org

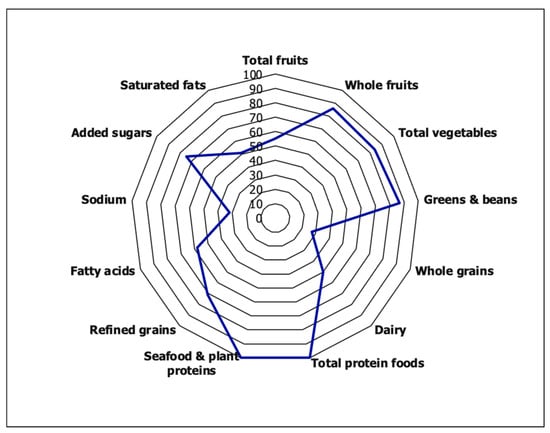

Nutrients Free Full Text Impact Of Covid 19 Infection And Persistent Lingering Symptoms On Patient Reported Indicators Of Nutritional Risk And Malnutrition

Research Study Options Challenges To Financing The Coal Transition In Spipa Countries By Climate Company Issuu

Pdf Green Energy And Sustainable Development

University Of Maryland Baltimore County The Princeton Review College Rankings Reviews

First Principles Collision Cross Section Measurements Of Large Proteins And Protein Complexes Analytical Chemistry

2800 Carrollton Road Finksburg Md 21048 Mls Mdcr2012628 Listing Information Long Foster

New Tax Law Take Home Pay Calculator For 75 000 Salary

Docs Changelog Rst At Develop Conan Io Docs Github